A separate currency market: a means or an end to stabilizing the economy?

19 December 2025

19 December 2025

Three official exchange rates that should gradually converge into one; three segments of economic participation, one for each rate; and modifications that will incentivize foreign currency income from exports, as well as the existence of a legal, objective, secure, and transparent exchange market, which will also be accessible to individuals and non-state forms of management, were established on Thursday.

Of the actions planned in the Government Program to correct distortions and boost the economy, and more specifically for macroeconomic stabilization, the transformations of the exchange market had been recognized as one of the most complex to implement, mainly due to the lack of foreign currency, the country's trade imbalance, and the deterioration of the economy's productivity.

However, it was no longer possible to wait for a more favorable scenario to take this step, and although conditions were being created—such as the new mechanism for managing, controlling, and allocating foreign currency, approved a week ago and in effect since yesterday—the truth is that no measure would be complete without establishing a foreign exchange market.

In conversation with Ian Pedro Carbonell Karell, director of Macroeconomic Policy at the Central Bank of Cuba (BCC), these exchange rate changes could not be postponed in order to organize the flows of foreign currency exchanged for national currency; to ensure that all these operations are carried out through the financial banking system; to rapidly stimulate exports, foreign income, and investments; and that, in line with the country's real economic situation, there would be a market that functions on the basis of objective exchange rates, without the high volatility and speculative movements that currently affect both families and businesses.

"These are also changes that give legal access to foreign currency to many actors who did not have it until now and who resorted to the informal market," he said.

– Why three segments with different exchange rate regimes?

– The design at this initial stage takes a gradual approach, because it is not advisable to move to exchange rate unification immediately, all at once, as this would have very negative results for the economy. In other words, we are not applying shock therapy here. Therefore, this approach envisages the existence of three exchange rate segments, each with a different official exchange rate.

"Given the current conditions of our economy, this is the alternative that allows us to move gradually toward the ultimate goal of convergence, for a unified exchange rate, without causing severe damage to productive activity and, at the same time, allowing agents to adapt adequately to the new conditions."

"Segment I includes exporting entities, which generate foreign currency and will maintain the current rate (1x24); however, from the foreign currency accounts that they will now retain from their income, they will be able to exchange it for national currency on the market, but at the rate established for Segment III, which includes individuals and non-state forms of management."

"This better rate will allow them to earn more Cuban pesos for each dollar they generate. This will enable these entities to pay better salaries, make investments, cover certain expenses in national currency to develop their activity, and generate higher incomes."

"Here, the exchange rate changes are seeking to incentivize and strengthen the export sector, because it is the largest generator of foreign currency for the country, and to sustain, from the revenues of the Central Treasury, the basic needs of our population; for example, those related to the standardized family basket, medicines, fuel, electricity, transportation..."

"Segment II will include certain entities that generate foreign income, with a different exchange rate regime (1x120), which will tend to provide resources to meet the basic needs of Segment I. Segment II will guide the process of convergence towards a single exchange rate for the entire economy."

The Director of Macroeconomic Policy at the BCC explained that Segment III incorporates one of the most innovative elements of the exchange rate transformation: the modification of the exchange rate regime applicable to individuals and non-state forms of management.

He explained that the rate applicable to this segment will be floating; that is, it will vary according to the actual conditions of the economy, even on a daily basis, based on the dynamics of operations in this market and other elements of the macroeconomic environment.

"This provides a more solid foundation for the exchange rate that will be the benchmark for all participants in this segment, removing any element of manipulation and speculation."

"Individuals will be able to sell their foreign currency at banks and exchange houses within the national banking and financial system, which means they can do so in a secure location and at an attractive rate."

"They will also be able to buy foreign currency, although this will depend on the availability at the bank, which, as a rule, will only sell what it collects from purchases."

Carbonell Karell specified that, in this initial stage, the limit of up to US$100 per transaction will remain in place, using the same mechanisms as at present. He added that as this market grows, new branches will be opened throughout the country—there are currently 41—offering this cash purchase and sale service, according to the daily rate published on the BCC website.

"The consolidation of the market itself will determine the relaxation of these controls," he said.

– What will happen to freely convertible currency (MLC) cards?

– The banking and financial system maintains its position that these are foreign currency accounts that will remain fully operational, as they have been until now, and now, with the implementation of the new mechanism for managing, controlling, and allocating foreign currency, there is the possibility that they will be able to recover their functionality more quickly.

– What benefits does inclusion in Segment III entail for non-state forms of management?

As a result of these exchange rate changes, non-state forms of management, which previously did not have legal access to foreign currency through the exchange market for investments or restocking, will now be able to access it by submitting requests to their commercial banks and through the bank accounts that the new mechanism allows them to create.

"However, the foreign currency purchasing power of non-state management entities will be limited to 50% of the average gross income reflected in the fiscal account for the last quarter. This is a positive development, as it was not considered appropriate to set a fixed amount for economic actors when they have different levels of activity."

"Also, if they manage to establish links with any other entity, such as suppliers of goods or services, they can agree on a direct purchase and sale of foreign currency," he added.

Carbonell Karell highlighted how the requirement to operate from funds registered in the tax account of the non-state management form will be aligned with the objectives designed in the banking process, which is conceived so that operations are transparent and secure, run through the channels of the financial banking system, there is greater collection and control of cash in circulation —which is currently excessive and generates inflation—and helps prevent tax evasion.

WHAT TO EXPECT?

Banking authorities believe that the start of these transformations marks a turning point in the management of the country's monetary and exchange rate policy and lays the foundations for the achievement of the strategic objective of exchange rate unification and the de-dollarization of the Cuban economy.

However, they have made it clear that these changes are not an end in themselves, but rather a means to achieve the desired goal of stabilizing a macroeconomy that inevitably needs foreign currency to develop.

Will these measures eliminate the illegal currency market at a stroke? That would be a naive conclusion, especially since the consolidation of the official exchange market will be gradual, as the new incentives translate into foreign currency liquidity that increasingly meets demand. Of course, we cannot ignore the "creativity" with which the declared enemies of Cuban sovereignty are reinventing themselves to try to thwart any strategy for the recovery of the national economy.

What is clear is that these steps cannot be postponed, because "straightening out" the economy requires resources, and here the aim is, first, to create favorable conditions to attract those resources (more foreign currency income from abroad) and, second, to create them here (produce more goods and services); so that Cubans, who have been so hard hit by prolonged shortages, can feel confident that the new explanations and measures will finally translate into results that truly impact their quality of life.

Related News

The youth of Latin America and the Caribbean deserve to have books in their hands, not jus...

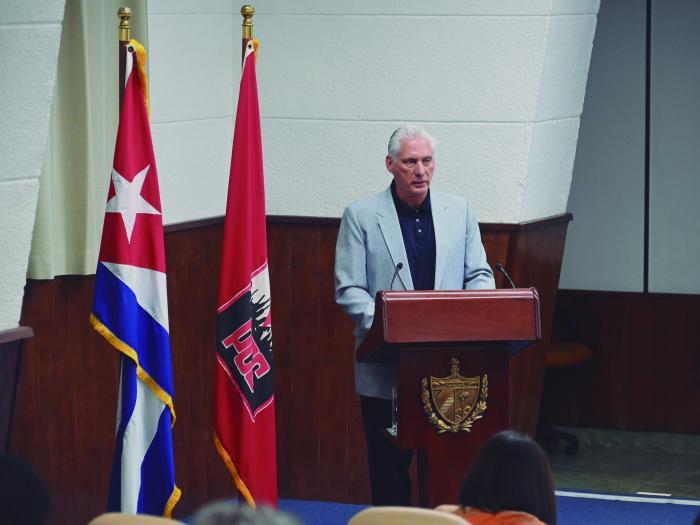

Díaz Canel: "We are making history every day, right now"

The unity we need today is that of those who argue strongly, but march together